An appraisal is completed by a licensed professional to determine a fair price for a home. It is one of the tools used to create a fair housing market.

Unfortunately, many sellers are all too familiar with the challenges associated with a house appraisal that is lower than the buyer’s offer.

The most experienced homeowners know that an appraisal can make or break a closing.

How Often Do Home Appraisals Come In Low?

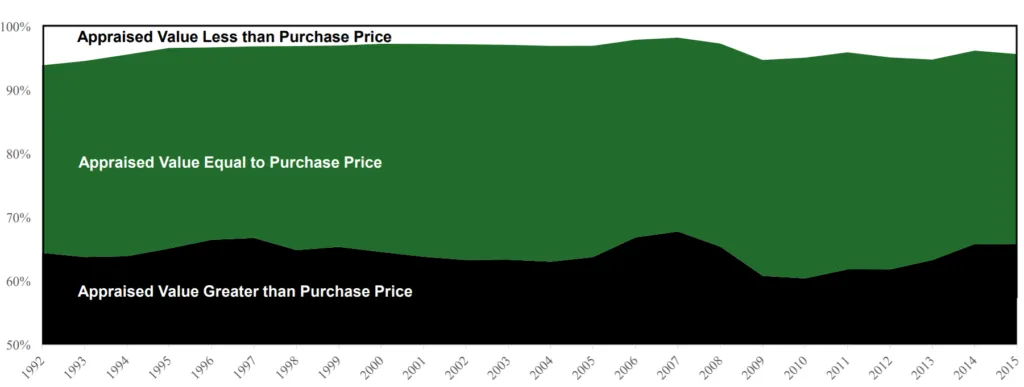

More often than not, an appraisal comes in around what the seller expected. According to Fannie Mae, the vast majority of appraisals confirm contract price, with the share peaking at 98% in 2007.

Following increased appraisal scrutiny, the share dropped towards 90% and is now closer to 95%.

According to the most recent data, appraised values come in below contract ~8% of the time and these cases are much more likely to result in a renegotiation in the borrower’s favor. Not the sellers.

Other findings from the study concluded:

- The vast majority of purchase appraisals confirm the contract price both before and after appraisal reforms were introduced in the wake of the financial crisis

- We find evidence of confirmation bias when appraisers are informed of the contract price. In particular, appraisers put more weight on higher valued adjusted comps in order to confirm contract prices

- We also find that appraisers are slightly more likely to confirm contract price for transactions involving financial institutions, brokers and loan officers that they work with most frequently

- Confirmation bias is potentially costly because it distorts the LTV and expected risk of loans and also limits the opportunity for borrowers to renegotiate with sellers

In a buyer’s market, where inventory is high, a low appraisal means that the seller will have to lower the price if they want to sell their home quickly.

It makes sense that a buyer may want to back out of the sale if they have to scrape up thousands of dollars just to meet the appraisal.

Selling in a buyer’s market also means that sellers might not get the full ROI for any interior or exterior upgrades that they have made on their home.

In a seller’s market, a low appraisal is typically less detrimental. In this type of market, a buyer is more likely to overpay for the home due to lower inventory, increased competition, and bidding wars.

In conclusion, the true impact and frequency of low appraisals will vary depending on the local and national real estate markets.

How Can A Low Appraisal Hurt The Seller?

According to the National Association of Realtors (NAR), issues related to financing and appraisals account for 46 percent of delayed contracts.

Buyers often have contingency contracts that will allow them to back out of purchasing a home if the appraisal is far below the expected value.

Some contingent contracts will also include wording regarding a low appraisal and the subsequent price that the buyer is willing (or obligated) to pay.

In these instances, the buyer can walk away penalty-free if the appraisal is too low; unfortunately, this leaves the seller without a buyer and stuck with a home that is worth far less than they first envisioned.

It also means that the seller must find a new buyer before restarting the entire sales process. In short, a low appraisal leads to costly delays and homes that sit on the market for extended periods of time.

Is Your House Appraisal Lower Than Offer?

If your house appraisal is lower than the offer then there are a few steps that you might need to take.

Depending on the buyer’s level of interest, you will most likely have to lower your asking price. In some cases, you can dispute the appraisal and ask for another professional review.

However, if you dispute the appraisal, then you might have to pay for the second opinion. You can also choose to remove your listing and relist it later as you wait for the market to turn in your favor.

The latter strategy assumes that you don’t need to immediately sell your home and that you can wait to see a more competitive seller’s market.

In some cases, a lower appraisal can change the buyer’s mortgage terms. An interested buyer will make up the difference in terms by paying a higher down payment.

However, a buyer that is interested but unable to come up with the additional cash, might turn to you for help.

You can choose to take on a second mortgage that covers the cash difference. The buyer will eventually need to pay you back.

This alternative is risky because it relies on the buyer eventually paying you back, forces you to take a second mortgage, and puts you at a higher debt to income ratio.

Don’t Let A Low House Appraisal Ruin Your Selling Opportunity.

Throughout the country, appraisals are often lower than expected. Appraisals can often ruin a pending home sale or force you to reduce your ROI by lowering the price.

The good news is that with the help of HomeGo you can skip the entire appraisal process.

HomeGo will make a firm offer for your home that won’t fall through. In fact, many homes close in as little as seven days.

If you want to avoid the financial challenges and emotional stress associated with the home appraisal process, contact HomeGo today.