When selling a home, people like to think about the profit they can pocket from the sale, but the reality is that you will also have a list of expenses to pay along the way. You might expect to give a commission to your real estate agent if you use one, but have you thought about the closing costs that are your responsibilities as the seller?

If not, you could be in for an unpleasant surprise when you walk away from selling your home with less than you expected. Here’s everything you need to know about who pays closing costs when selling a home, so you can budget accordingly.

What Is Closing on a Home?

Closing is the last step in the real estate process. It officially transfers ownership of the property from the seller to the buyer. In other words, this is the day when you will get your money and the buyer will get their new home. While closing is an exciting, long-anticipated event for both sides, it does come with some financial costs for both the buyer and the seller (more on those later).

The day before the closing, there is often a final walk-through of the home. This is when the buyer is checking that you, the seller, have made any promised improvements or repairs and that the property is free of personal possessions and move-in ready.

As long as you have the property in the condition agreed upon in the purchase and sale agreement (e.g. broom clean), then everything will be good to go for the closing. If something wasn’t attended to, you will either need to tackle it before the deal closes or grant the buyer a concession, typically in the form of credit.

During the closing, both parties will complete lots of paperwork, the buyer will officially pay for the home, and the seller will receive their profits. The closing date is set in advance and listed in the purchase and sale agreement, so you will have plenty of advance notice on when the closing will take place. Due to the amount of paperwork required, real estate closings usually take a few hours, meaning you will want to clear your calendar for the event.

What Are Closing Costs?

Homebuyers, as well as home sellers, are responsible for closing costs. Typically, real estate closing costs can run anywhere from 1 to 7 percent of the home sales price – a figure that can seriously eat into your profit margins. Fortunately, closing costs are generally split by the buyer and seller, which means your seller closing costs will be somewhere between 2 to 3 percent on average.

States and cities have different regulations for closing costs, which means closing costs for a seller in Florida may be very different from seller closing costs in Texas. In addition to knowing what you need to cover under closing costs, you also need to understand the laws in the area where you own property. This is straightforward when you’re selling a primary residence, but if you’re trying to sell an inherited house in another state, sellers closing costs can get confusing.

Sellers closing costs generally reflect various fees, such as:

- Attorney’s fees

- Real estate agent commission

- Title insurance fees

- Recording fees for taxes

- Homeowners association dues or condo fees

- Buyer’s credit for issues uncovered during a home inspection

The buyer usually covers items related to the mortgage loan, such as:

- Credit report fees

- Survey cost

- Home inspection fee

- Appraisal fee

- Real estate attorney fees

You may be wondering if the seller pays closing costs out of pocket. Generally speaking, you don’t need to pay out of pocket because the seller’s closing costs will be deducted from the home sale price or from a buyer’s deposit.

In this case, you will receive the home sales price less any money owed on your mortgage and closing costs. So if your home sold for $400,000 and you owed $50,000 on your mortgage and $10,000 in closing costs, including commission, you would receive $340,000 at the closing.

In some cases, sellers do need to pay out-of-pocket for closing costs; for example when there is not enough equity in the house or due to a short sale. If this is the case, then you will need to bring a check to the closing to cover your closing costs.

While these are the general guidelines, every real estate deal is different. If you are fortunate and it’s a seller’s market, you may get a buyer to cover some of your closing costs. In a poor real estate market (i.e. a buyer’s market), you may want to offer to cover some or all the buyers closing costs as a way to entice buyers.

While this means less money for you, it can even out if it leads to a faster sale where you make fewer mortgage payments than you would if waiting several months for an interested buyer to make an offer. A real estate agent can advise you if they think it’s beneficial that you pay buyer closing costs.

What is Included in Closing Costs?

Before we get into how is closing cost calculated, let’s look closer at the most common closing costs for sellers, so you have a better understanding of what is included in the closing costs a seller must pay.

1. Mortgage Payoff (May Include Prepayment Penalty)

This is straightforward: If you owe a mortgage, you must pay off the mortgage when you sell the home. Rather than take the entire profit and then pay the mortgage company, you must pay off your mortgage at the time of closing.

Some mortgage lenders assess a prepayment penalty, which is a financial penalty for paying off the mortgage early. If you sell the home, thus paying off the mortgage early, you’ll typically need to pay the prepayment penalty, too.

You can estimate this mortgage payoff amount by looking at the balance on your mortgage; however, you will need to call the lender to obtain the exact cost. Since mortgage interest accrues daily, the closing date will affect how much is owed on the mortgage.

2. Outstanding Amounts Owed on the Property

In addition to the mortgage, you may owe other amounts on your property. Outstanding costs could include condo fees, homeowners association dues, utility expenses, or municipal property taxes. You will be able to gauge any outstanding amount owed by looking at bills and recurring expenses, which may be due between the listing date and the closing date.

3. Seller’s Attorney Fees

If you have hired a real estate attorney for the transaction, which may not be required by your state but is often recommended, you will need to pay for their services. Any attorney will be able to advise you on the cost to represent you at closing before you hire them, so this will be a fixed expense for which you can budget.

4. Transfer Taxes and Recording Fees

States and counties have set tax rates; home sellers are generally taxed on the price of the sale. You can check with your state and county directly or ask your real estate agent how much you will need to pay to cover taxes.

The seller is usually responsible for fees associated with the recording. Again, the rate here is set by the county, which means you will need to check the price to record the deed under the buyer’s name.

5. Fees for Buyer’s Title Insurance Policy

Title insurance policies protect the buyer and seller from any problems with the title of the house that may come up after closing. If you or your buyer or chooses to buy a title insurance policy which may be optional but recommended, you will need to pay for the cost. Sellers usually pay for the buyer’s title insurance; the cost is around $1,000.

How Much Are Closing Costs?

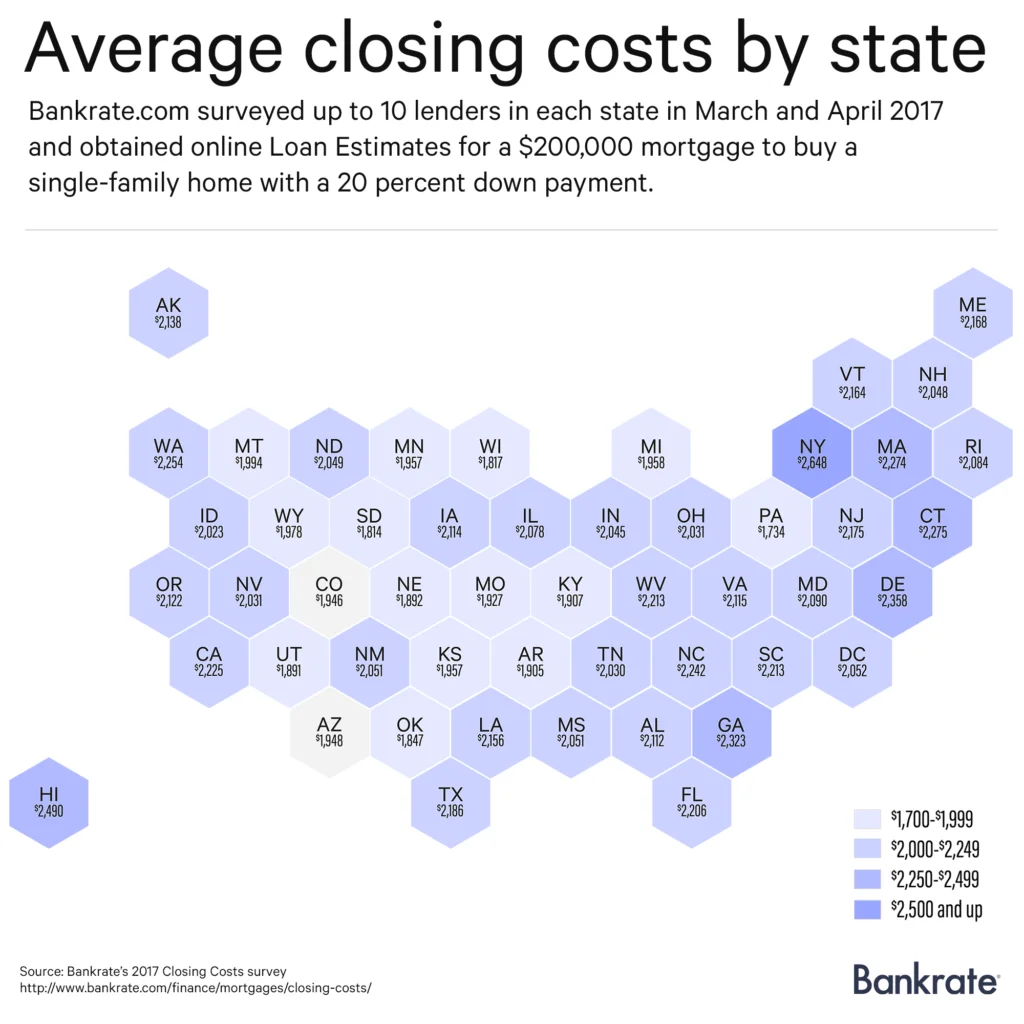

Closing costs vary by state and city, so there’s no set amount you can expect to pay as a seller. Bankrate examined closing costs in Iowa and New York and found that closing costs (both buyer and seller) for a $200,000 loan were $6,843 on average in New York versus $2,114 on average in Iowa.

As these numbers suggest, there’s a wide range in closing cost averages across states. Unfortunately, this is an area where you don’t have that much leverage to reduce costs, because the house is in a set location, which you can’t change. If your curious what to expect for your home’s closing costs, try a closing cost calculator. Remember, this is just a ballpark estimate, not a guaranteed rate.

How to Reduce Closing Costs?

Any time you can reduce closing costs as a seller, you automatically increase the amount of money you keep in your pocket.

In a strong real estate market, you can refuse to pay any of the buyer’s closing costs, which is a great way to save money.

Taxes and fees cannot be reduced or negotiated, so there is no way to save on this portion of your seller closing costs when selling the traditional way. However, there is a way to avoid all closing costs and fees – sell to HomeGo!

There are other areas where you can lower your expenses. An easy way to reduce closing costs is to reduce the costs of a service provider, such as your real estate agent or your attorney. Find out the commission of a real estate agent before you hire them, as commission rates vary. Ask a few attorneys for their rates and select a real estate attorney who charges lower rates to curb your costs. Apply this logic for buyers title insurance, too.

When Selling a House Who Pays for What?

Both buyers and sellers have the ability to negotiate the closing costs, so that’s something to note. As a general rule, here’s what you can expect to pay as a seller and what you can expect a buyer would pay.

As mentioned above, sellers must pay off their mortgage and handle any prepayment penalties. If you are unsure whether your lender has prepayment penalties, a quick phone call can get you an answer. Buyers must cover any outstanding fees owed on things like utility bills, school taxes, city taxes, or other outstanding payments.

Sellers pay a series of fees related to transferring taxes, recording the real estate transaction, and purchasing title insurance. Sellers working with real estate attorneys must pay their fees as well.

Buyers pay any fees associated with taking on their mortgage, including a credit report fee, which is sometimes required by the mortgage lender. Buyers pay for the title search, which makes sure that the home title is clear, as well as a fee for a home appraisal and home inspection.

If a survey is called for, buyers typically pay this as well. In some cases, there’s a settlement fee, which the buyer pays as well. Just as a seller pays their attorney fees, a buyer is responsible for paying their attorney fees, too.

Do Closing Costs Vary in Different States?

Not only do closing costs vary in different cities, but they also vary in states as well. So if you’re wondering whether closing costs vary in Florida versus California, you need to look at not only state rates, but the rates in cities as well–as Orlando may have a different closing rate than St. Petersburg.

Averages can help you get an idea of what to expect, but for the most accurate information ask your real estate agent what you can expect in terms of local taxes.

Within California, averages for closing costs are 2 to 3 percent–but of course, when you’re talking about a transaction that could cost $500,000, that one percent means a big deal.

Total closing costs in Florida are under 2 percent, so seller closing costs in Florida could be close to 1 percent assuming everything is split evenly.

Seller closing costs in Texas are high because total closing costs in Texas are closer to 7 percent and sellers generally pay half of that.

Taxes and fees set by the city and state are not something that a seller can negotiate. However, it’s important to know what you are liable for that is not up for negotiation, so you can look to negotiate (and save money) where you can.

How to Calculate Closing Costs

Closing cost calculators are designed to help you estimate what your closing costs would be, but these aren’t always the best way for a seller to know what their closing costs would be.

Most closing costs calculators are designed with the home buyer in mind, not the seller. If you look at any closing cost calculator, you will see things like mortgage amount, mortgage loan interest rate, and down payment amount–items that do not apply to the seller.

These calculators can be useful to home sellers who are in the position of paying some or all of the buyer’s closing costs, as they can plug in the accurate information to determine the costs to the buyer.

Your real estate agent can determine your closing costs, taking all factors into account. If you are selling your home without the aid of a real estate agent, then you’ll have to gauge closing costs on your own.

Look at the typical seller closing costs and determine which ones you’ll need to pay. Add up the costs for the amounts indicated, calling your city or state when necessary to get an up-to-date estimate on state and local tax rates.

By adding up all the figures, you will get an accurate, personalized sum of the closing costs you as a seller must pay.

Does the Seller Pay Closing Costs out of Pocket?

It is rare that a seller would be responsible for paying closing costs out of pocket; however, there are cases when a seller would do so.

If you’re selling your home for more than you paid for it, then the seller closing costs will come out of the money you receive from the buyer. Thus, you won’t need to write a check to the mortgage company to pay off your loan, because the mortgage lender will be paid off from the buyer. You’ll receive a check for the difference, i.e. the selling price of the home less the amount left on your mortgage.

If you are selling your home at a loss, where you paid more for it than you’ve accepted, you will have to pay closing costs out of pocket. In this case, it’s all the more important that you understand what your costs are so you can budget accordingly.

When Are Closing Costs Due?

Closing costs are officially due when the purchase and sale agreement is signed. This happens after you have accepted the offer, but before the closing. Remember that unless you are receiving a net loss for the sale of your home, you won’t need to actually cut a check.

Since every real estate deal varies, it’s difficult to say exactly when the closing costs will be due–it depends on when your purchase and sale agreement is ready. Nationwide averages for the entire home selling process, from listing a home to attending the closing suggest that homes sell within 68 days.

This estimate is useful as it helps you better understand how to handle ongoing expenses like mortgage payments up through the date of the closing.

Kick Closing Costs to the Curb

In a traditional real estate sale, closing costs are just a part of the process. Perhaps a better alternative to trying to reduce your closing expenses is to not pay them at all! With HomeGo, you’ll never be asked to pay any fees or expenses, including real estate commission and closing costs. We believe the profit from your sale should stay where it belongs, with you.